Seoul: Samsung Electronics is expected to report strong second-quarter earnings on the back of its semiconductor business that offset a lukewarm performance of the mobile unit, analysts here said on Thursday.

The South Korean tech giant was projected to log 11.2 trillion-won (US$9.9) billion in operating profit for the April-June period, up 37.6 percent from a year earlier, while its sales were estimated to increase 15.8 percent on-year to 61.3 trillion won over the period, according to the data from 15 local brokerage houses compiled by Yonhap Infomax, the financial news arm of Yonhap News Agency.

Its improvement may have been partly affected by a base effect. Still, Samsung’s second-quarter operating profit was estimated to be up 19.5 percent from the first quarter of 2021, according to analysts, although its revenue was projected to fall 6.2 percent.

Samsung, the world’s largest memory chip and smartphone producer, will announce its second-quarter earnings guidance next week.

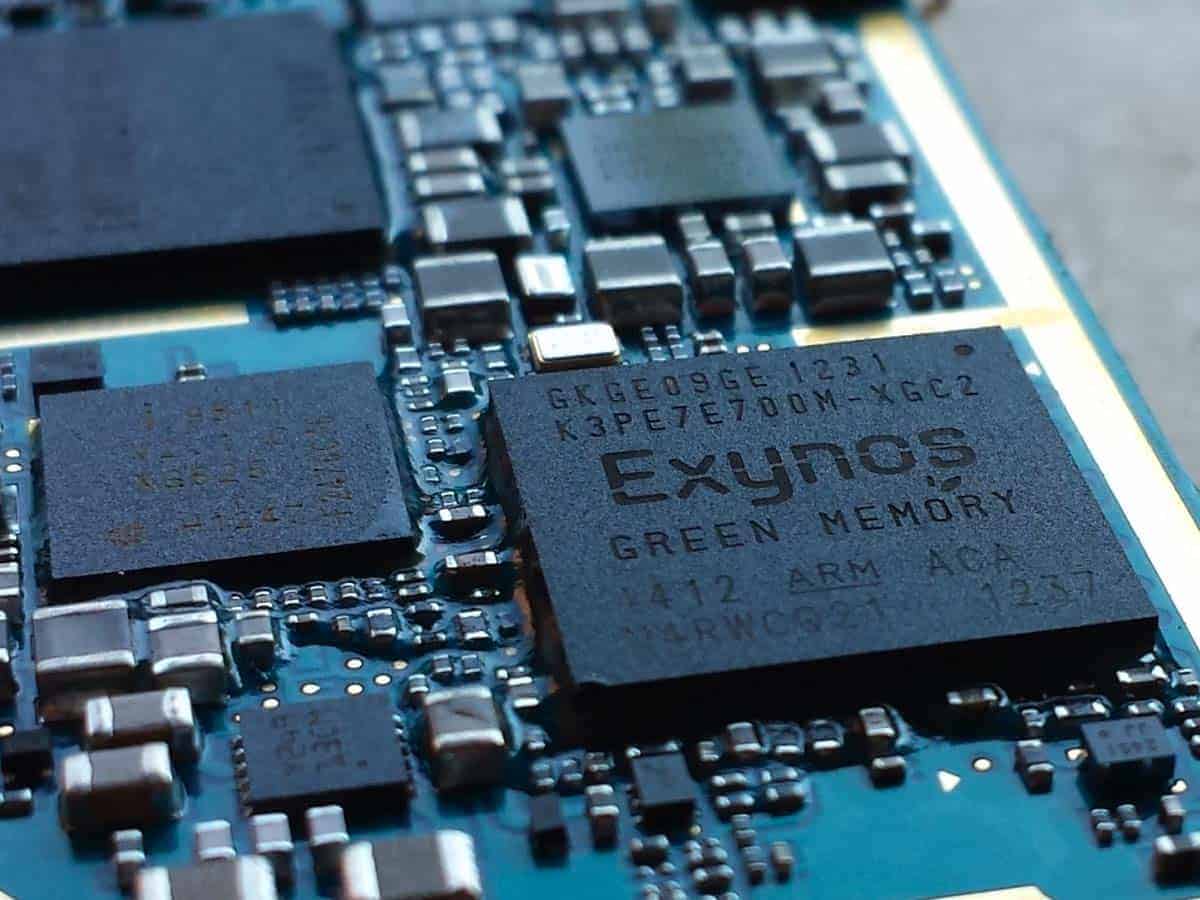

Analysts forecast that Samsung’s semiconductor business anchored the company’s performance in the second quarter thanks to price hikes in memory chips and the normalisation of its foundry line in Austin, Texas.

They predict Samsung’s chip business would post more than 6.5 trillion won in operating profit for the second quarter, nearly double from the first quarter.

“Operating margins for both DRAM and NAND were estimated to have increased from the first quarter apparently due to a price increase, improved product mix and yield rate,” said Kim Un-ho, an analyst at IBK Investment & Securities. “Its Austin semiconductor fabrication plant shifting to the black also helped.”

Analysts estimated Samsung’s DRAM average selling price increased by around 15 percent, while that of NAND went up around 3 percent in the second quarter.

Samsung suffered a monthlong shutdown of its Texas fab after a severe snow storm caused power and water outages in February. It went back to full operations in April, but the company suffered more than 300 billion won in losses.

Samsung’s mobile business was predicted to report tepid earnings compared with the first quarter due to weak seasonality, coupled with the resurgence of COVID-19 in major markets and chip shortages.

Analysts predict Samsung’s IT & Mobile Communications unit to log around 3 trillion won in operating profit for the second quarter, with some expecting its smartphone shipments to decline more than 20 percent from a quarter earlier.

“There seems to have been a decline in demand in India, as well as its production disruption in Vietnam due to COVID-19, while a short supply of application processors for some smartphone models appear to have affected its performance,” said Lee Seung-woo, an analyst at Eugene Investment & Securities.

Earnings from Samsung’s Consumer Electronics (CE) division, which manages TVs and home appliances, were expected to be flat or slightly lower from the first quarter with around 1 trillion won in operating profit.

“Its TV sales may have declined slightly, but due to demand of seasonal home appliances, the CE unit is likely to report similar earnings like the first quarter,” said Lee Soon-hak, an analyst at Hanwha Investment & Securities.

Samsung’s display panel business was projected to report improved performance from the first quarter with an estimated 1 trillion won in operating profit when a one-off gain is reflected in its second-quarter earnings.

For Samsung’s earnings in the second half of the year, many analysts had a positive outlook with its semiconductor business again leading the way.