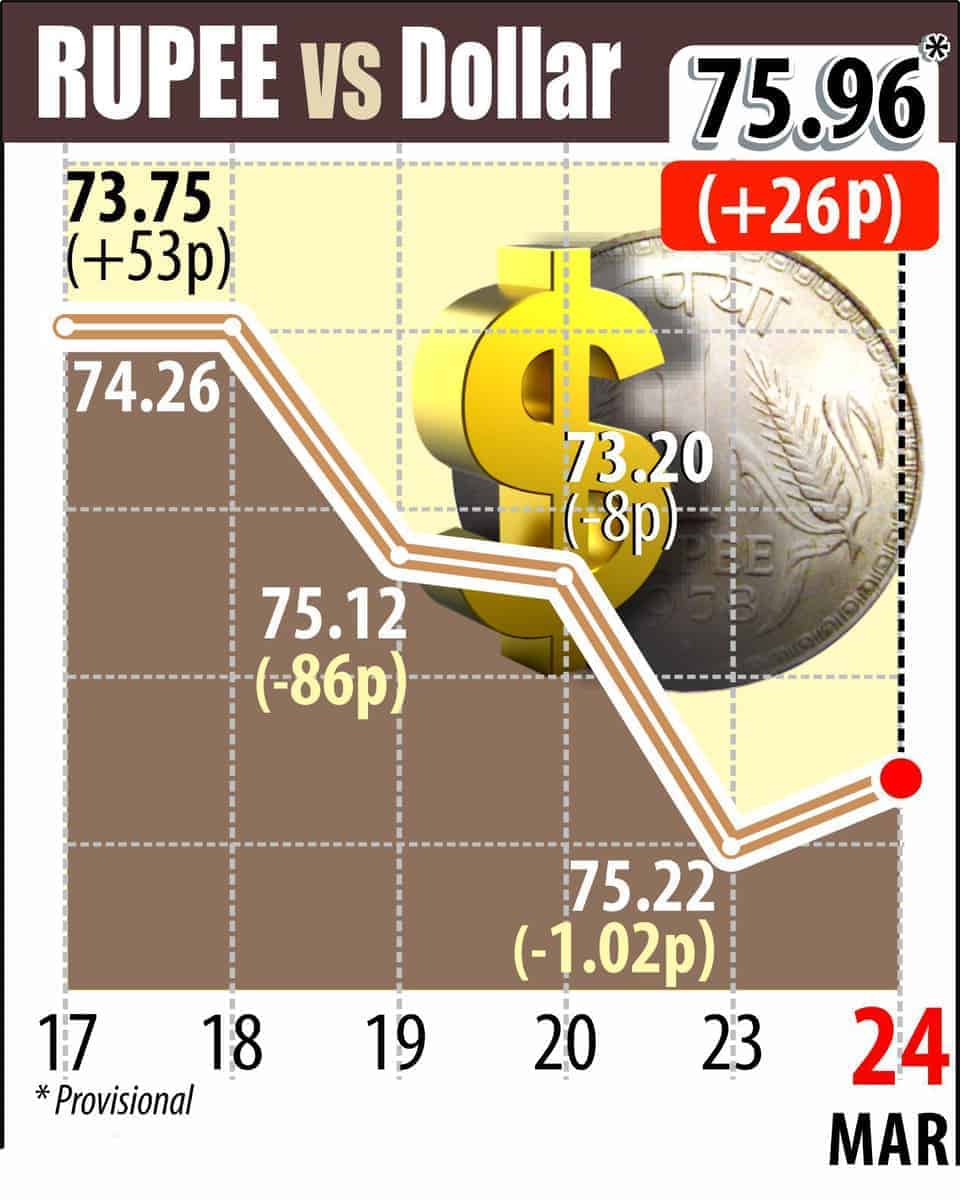

Snapping its four-session losing run, the rupee on Tuesday gained 26 paise to settled at 75.94 (provisional) against the US dollar after Finance Minister Nirmala Sitharaman said the government is working on an economic package to deal with the coronavirus crisis.

Forex traders said the rupee which started the day on a positive note, witnessed heavy volatility amid concerns over the impact of coronavirus outbreak on the domestic economy but recovered after the government said an economic package is under works to tackle the coronavirus-led lockdown.

Moreover, the recovery in domestic equities, which closed 693 points higher on Tuesday, also supported the local unit.

At the interbank foreign exchange market, the local currency opened at 76.02. During the day it saw a high of 75.94 and a low of 76.40 against the American currency.

The domestic unit finally settled at 75.94 against the greenback, up 26 paise over its previous closing price.

The local unit had settled at 76.20 against the greenback on Monday.

Finance Minister Nirmala Sitharaman on Tuesday said regulators and her ministry are monitoring developments and volatility in stock markets.

She said the developments on stock markets are monitored thrice a day.

The government is working on an economic package to deal with the hardships caused by the lockdown to control the coronavirus crisis and the same will be announced soon, she said adding different sub-groups have held sectoral discussions.

“Market participants will be keeping an eye on the preliminary manufacturing PMI number that will be released from the US. At the same time focus will be on the Senate vote for a coronavirus rescue package. We expect USDINR(Spot) to quote in the range of 75.80 and 76.80,” said Gaurang Somaiyaa, Forex & Bullion Analyst, Motilal Oswal Financial Services.

Traders said investor sentiment improved after the Reserve Bank as part of its effort to boost liquidity said it will conduct Rs 1 lakh crore of short-term variable repo auction.

The repo auctions will be conducted in two tranches. The first repo auction of Rs 50,000 crore was held on Monday.

The second tranche of Rs 50,000 crore of repo auction was to be conducted on Tuesday.

However, there are still concerns over the impact of coronavirus outbreak on the domestic as well as global economy. The number of deaths around the world linked to the new coronavirus has reached over 17,000.

Meanwhile, over 500 coronavirus cases have been reported in India so far, according to Health Ministry data on Tuesday.

Fitch Solutions on Tuesday revised down its forecast for the Indian rupee, saying the currency will average 77 per US dollar in 2020 and 80 in 2021 amid ongoing global risk-off sentiment and likely steep monetary easing.

According to CARE Ratings, the rupee is likely to further depreciate to 77 in the next few sessions as the dollar buying continues amid higher demand from foreign investors.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, fell 1.13 per cent to 101.32.

The 10-year government bond yield was at 6.30 per cent.

Global crude oil benchmark Brent rose 3.70 per cent to USD 28.03 per barrel amid concerns over global growth.