Bangalore: As per Counterpoint Research’s latest analysis on the important Indian smartphone”>Indian smartphone market, the premium smartphone segment (>Rs. 30,000) shipments reached an all-time third quarter peak during Q3 2018 as attractive offers have lowered down the cost of ownership for a premium smartphone in India in the recent past.

Typical offers include trade-ins and buybacks, monthly 0% EMI (monthly installment plans) and instant cashbacks.

These offers strongly appeal to large sections of the population, especially the youth, that are gaining their footing financially and growing into power smartphone users. Furthermore, the features in premium segment smartphones such as full-screen displays, biometric security, dual-cameras, faster processor and support for artificial intelligence have acted as a catalyst for consumers looking to upgrade from a mid-range smartphone.

“OnePlus has managed to build a strong brand name for itself in premium smartphone segment in a short span of time. The product strategy remains strong with couple of flagships per year, promising the latest innovations in premium segment at an aggressive price. This has helped them to attract new users looking to purchase their second or a third smartphone. Additionally, strong word of mouth and smart social media strategy has helped it to gain mind share in recent quarters,” said Tarun Pathak, Associate Director, Counterpoint Research.

Market Summary:

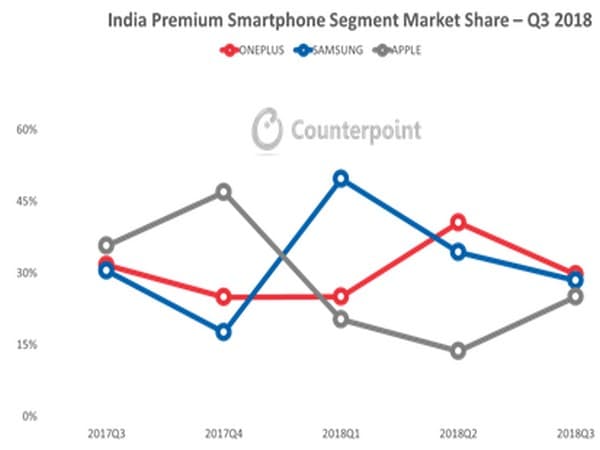

•The top three brands Samsung, OnePlus and Apple contributed to 83% of the overall premium market as compared to 88% a quarter ago.

•This is due to the entry of new players in the segment led by Vivo (Nex), OPPO (FindX), Huawei (Nova 3), Asus (Zenfone 5Z), LG (G7+ ThinQ)

•OnePlus led the premium smartphone segment for the second successive quarter, capturing 30% of the market driven by strong performance of OnePlus 6. The strong word of mouth along with effective social media strategy has helped OnePlus in targeting new user base

•OnePlus 6 became the highest selling flagship model for OnePlus within five months of its launch.

•OnePlus continues to increase its points of sale by launching its offline and exclusive stores across key cities. This has helped the brand to reach out to a larger user base.

•Samsung captured 28% share of the premium segment. Demand for Samsung’s flagship S9 series begin to taper off during the quarter but initial demand for its new Note 9 launched in August was strong. It held on to the number two spot in the premium segment in India driven by new A series and Note 9 launch in premium segment

•Apple’s share in the premium segment reached 25% during the quarter due to the launch of its flagship iPhone XS and XS Max in India. However, the new devices are unlikely to offset the high import duty due to absence of local manufacturing. This has made new iPhones expensive as compared to their pricing in other key countries.

•In addition to a growing affordable population, competition among distribution channels is driving down the cost of ownership through a range of attractive offers. Cashback and EMI offers remain popular for premium smartphones across various channels.

•In terms of best-selling models, OnePlus 6 remain the best-selling model in premium segment followed Galaxy Note 9 and Galaxy A8 star.

[source_without_link]ANI[/source_without_link]