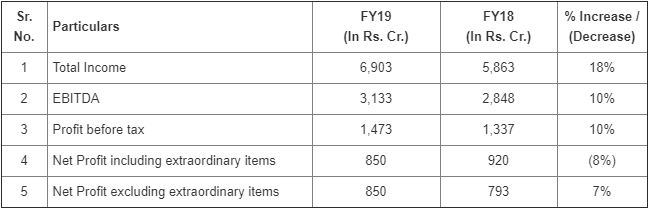

Mumbai: IRB Infrastructure Developers Ltd (IRB), India’s leading and one of the largest highway infrastructure developers, have posted Consolidated Income of Rs 1,999 Cr for Q4 and Rs 6,903 Cr for entire FY19; which is up by 40 per cent and 18 per cent respectively as compared to the corresponding period of FY18.

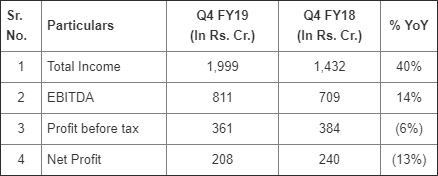

For the entire FY19, Company’s EBITDA went up by 10 percent to Rs 3,133 Cr; whereas the Q4 EBITDA went up by 14 percent to Rs 811 Cr Company registered Q4 profit of Rs 208 Cr.

The Company, in its Board Meeting today held at Mumbai, announced the Q4 FY19 Financial Results.

“It was yet another remarkable year as we clocked 18 percent revenue growth, even with transfer of seven operating assets to IRB InvIT last year, and successful completion of Pune Solapur concession this year. We started our first HAM project in Gujarat and construction is going on full swing across projects. With almost Rs. 11,000 Crs of order book we have strong visibility over the following two years, which will keep improving with the addition of new projects.

We expect the pace of awards to strengthen with elections now being over and a large number of projects already lined up by NHAI. A very welcoming move from the Authority includes an increased proportion of projects being considered on BOT model which we will continue to participate as the opportunity unfolds”, said Virendra D. Mhaiskar, Chairman & Managing Director, IRB Infrastructure Developers Ltd.

The highlights of IRB Infra’s Financial Performance are as follows:

Q4 FY19 v/s. Q4 FY18

FY 2019 v/s. FY 2018

The highlights of business performance for FY19 are:

* Achieved Project COD for the Yedeshi – Aurangabad BOT Project and started tolling.

* Refinanced project debt for Kaithal Rajasthan from 11 percent to 9.5 percent, implying yearly savings of 150 bps on a debt of approximately Rs. 1400 crores.

* Received Appointed Date from NHAI for Vadodara – Kim Expressway project under Hybrid Annuity Model; construction activity commenced.

* Achieved Financial Closure for all three HAM Projects at the Bid Project Cost, despite the tough lending scenario and market conditions.

* CRISIL has initiated credit rating with “A+ Positive Outlook” for long term loan facilities.

This story is provided by NewsVoir. ANI will not be responsible in any way for the content of this article.

[source_without_link]ANI[/source_without_link]