Mumbai: The Future Retail Ltd. (FRL) will go into liquidation if its deal to sell assets to Reliance Industries fails; the group told a Singapore arbitrator while arguing against Amazon Inc’s bid to halt the deal. Amazon on Sunday found relief after it won an injunction from a Singapore arbitrator to halt the Reliance’s deal to buy FRL’s assets.

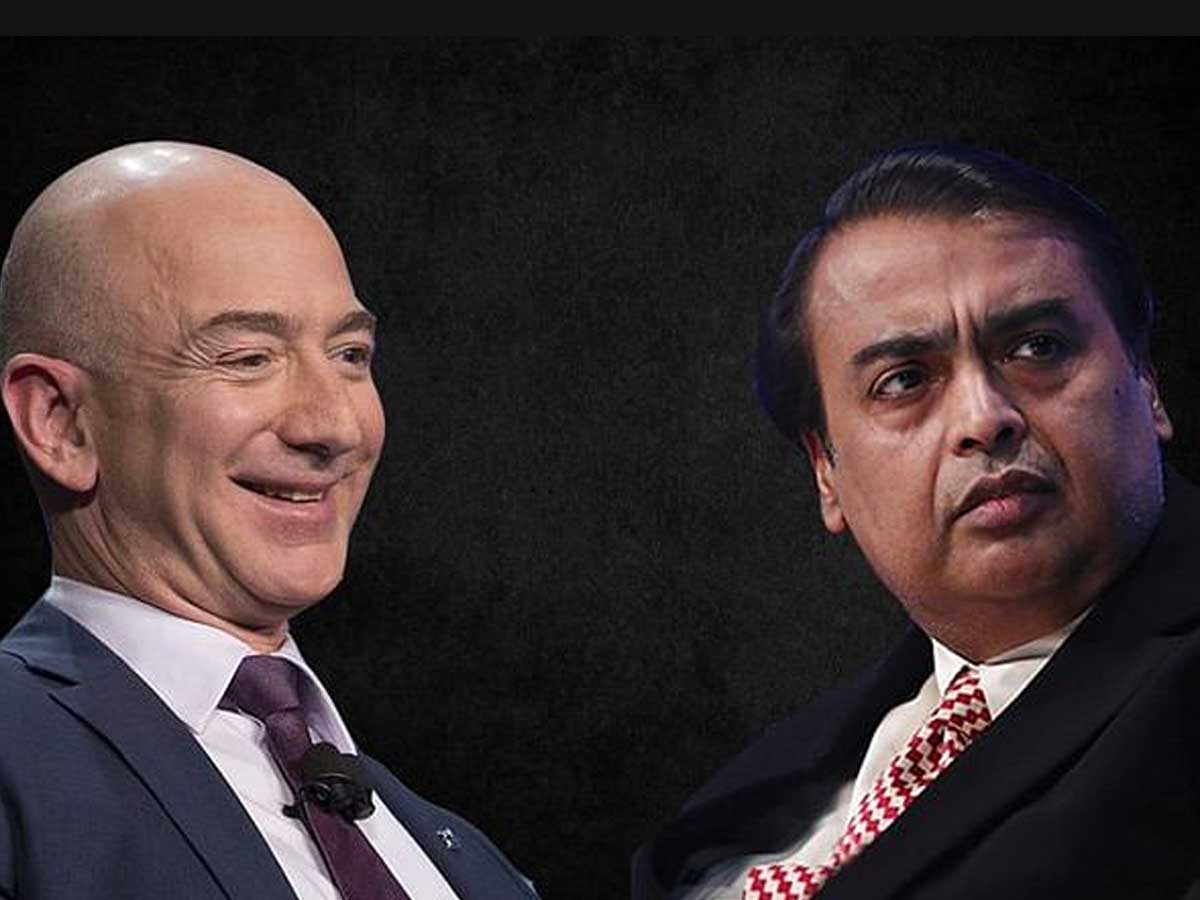

The dispute centers on FRL’s decision in August to sell its retail, wholesale, logistics and some other businesses to Reliance for $3.38 billion, including debt. Amazon alleged that the FRL had breached certain provisions of the contract, which both the companies entered into last year. Amazon argued that a 2019 deal it had with a Future unit had clauses saying the Indian group couldn’t sell its retail assets to anyone on a “restricted persons” list including any firms from Reliance chief Mukesh Ambani’s group. The deal specified any disputes would be arbitrated under Singapore International Arbitration Centre rules.

Future’s retail unit—which has more than 1,500 outlets—will need to pack up if the transaction with Reliance doesn’t go through, hitting the livelihoods of thousands of employees and workers at its vendor firms, the Indian group argued before the arbitrator, according to the order which is not public. “If the disputed transaction falls through, FRL will go into liquidation. That will mean that the livelihoods of more than 29,000 employees of FRL will be lost,” the Indian group’s representatives told the arbitrator V.K. Rajah, a former attorney general of Singapore.

The COVID-19 pandemic has hit many Indian businesses, especially in the retail sector, and the FRL-Reliance deal was aimed at protecting the interests of all stakeholders through a large infusion of funds and the acquisition of liabilities, Future argued at the tribunal. But Rajah ruled that “economic hardship alone is not a legal ground for disregarding legal obligations”.

The latest tussle puts Amazon at odds not just with FRL but also Ambani and his Reliance group which is fast expanding its e-commerce business, and threatening the dominance of Amazon and Walmart’s Flipkart in that space.