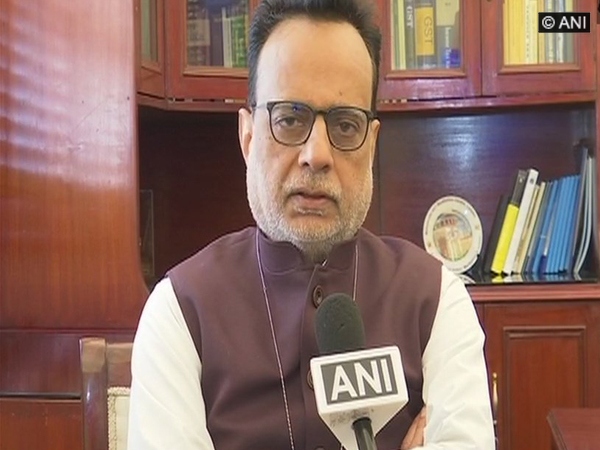

New Delhi [India]: Finance Secretary Hasmukh Adhia on Saturday said the Goods and Services Tax (GST) needs further simplification and suggested a reduction in the number of slabs if there is any scope to do so.

“While the reduction in the number of slabs should be done, there is a need to understand if this is possible or not. For example, if the five percent tax slab is removed, then these items would be shifted to one of the higher slabs. This might have a detrimental impact on common man, as most items in this slab are essential commodities. If there is any scope to reduce the number of slabs, it should be done,” Adhia told ANI.

Adhia suggested that the GST rate cut benefits must be passed onto consumers, and added that companies should paste stickers of the revised maximum retail prices on their products at the earliest possible date.

He also claimed that a decision regarding the formation of a National Anti-Profiteering Authority would be announced next week.

“We request companies to pass on benefits to consumers immediately if you do not want the action of the National Anti-Profiteering Authority (NAA),” he stated, while urging companies to immediately alert consumers about the slash in the rates of products by putting advertisements in newspapers and other forms of media.

Earlier, Chief Economic Adviser Arvind Subramanian, addressing the ICFAI Institute of Higher Learning in Hyderabad, hinted at a reduction in the number of tax slabs under the GST, with the merger of 12 percent and 18 percent tax slabs into one.

A similar view was expressed by NITI Aayog Vice Chairman Rajiv Kumar. He also suggested that petroleum and electricity be brought under the ambit of the taxation scheme.

The 23rd GST Council meeting held earlier this month saw GST on as many as 178 items being brought down from the 28 percent to the 18 percent tax bracket.

In a major boost to the service category, GST in restaurants underwent major changes with ITC (input tax credit) getting cancelled to all restaurants barring starred hotels.

However, it was also noted that all stand-alone restaurants irrespective of air conditioned or otherwise, will attract five per cent without ITC. Food parcels (or takeaways) will also attract five percent GST without ITC. (ANI)