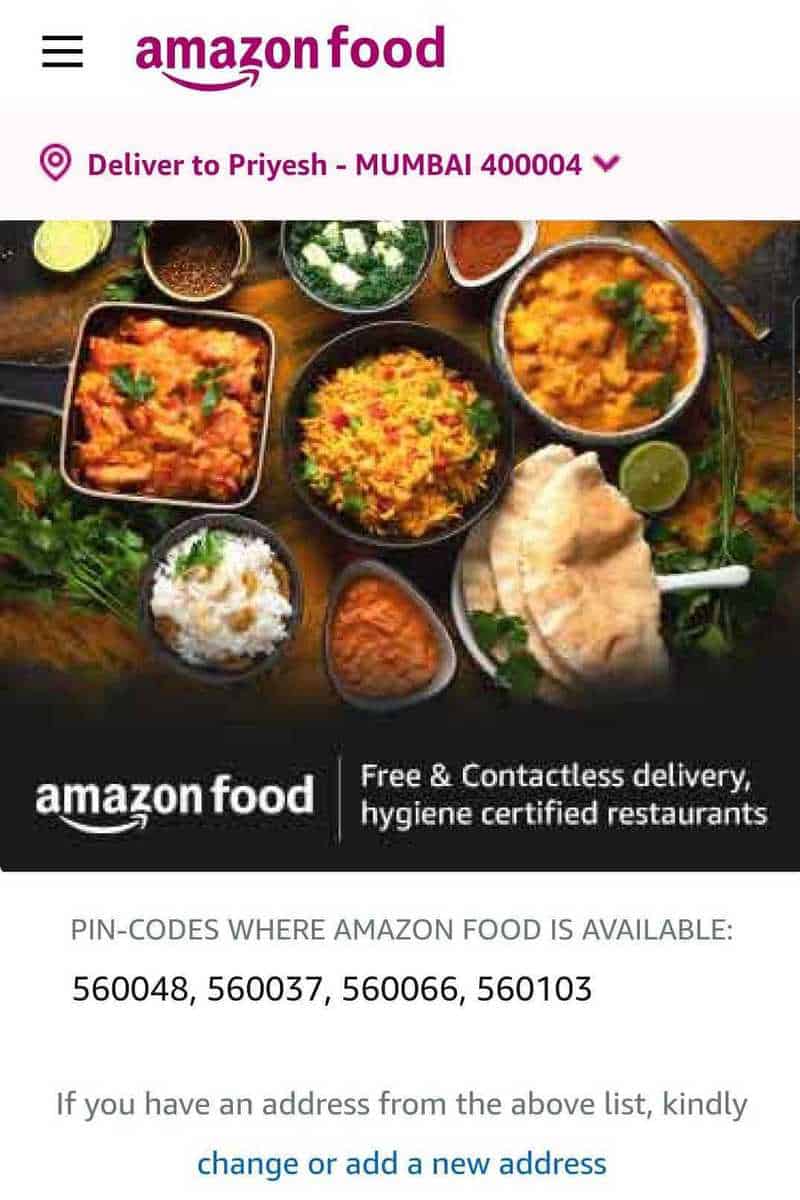

New Delhi: In a strong signal to leading players Zomato and Swiggy who have been severely hit by COVID-19, e-commerce giant Amazon with deep pockets on Thursday announced it has entered the vast online food delivery market in India, with introducing Amazon Food at select pin codes in Bengaluru.

Amazon Food is currently allowing customers to order from hand-picked local restaurants and cloud kitchens that pass its “high hygiene certification bar”.

“Customers have been telling us for some time that they would like to order prepared meals on Amazon in addition to shopping for all other essentials,” an Amazon spokesperson said in a statement.

“This is particularly relevant in present times as they stay home safe. We also recognise that local businesses need all the help they can get,” the company spokesperson added.

The India market is piping hot as according to a recent study by business consultancy firm Market Research Future, the online food ordering market in India is likely to grow at over 16 per cent annually to touch $17.02 billion by 2023.

According to Prabhu Ram, Head-Industry Intelligence Group (IIG), CMR, unlike other markets, the food delivery market in India is tough to crack, especially from a profitability perspective.

“That said, in a post-virus era, the online food delivery market in India is positioned for growth. From the short- and long-term view, Amazon’s entry into the food delivery market is opportune,” Ram told IANS.

The e-commerce giant has already pumped in more than $6.5 billion in India and the vast online food landscape is a lucrative opportunity once the lockdown opens and people get to order food more.

Reports surfaced last year amid Zomato-Swiggy merger talks that Amazon was gearing up to launch its own online food delivery division to compete with food delivery apps in the Indian market.

The retail behemoth already has a robust existing workforce in the country that can be utilized along with hiring more delivery partners to beat the competition.

In the next three years, the food tech industry in India is going to grow from $4 billion to $15 billion.

Zomato in January acquired Uber’s Food Delivery Business in India in an all-stock deal of nearly Rs 2,500 crore, with Uber taking 9.99 per cent stake in the Deepinder Goyal-led food delivery platform.

Uber started its food delivery service in India around mid-2017, but never succeeded in scaling up its business in the face of big players like Zomato and Swiggy.

Amazon Food, however, is no Uber Eats and a Zomato-Swiggy merger can only offer some tough competition to the behemoth which has billions of dollars in cash to spend on the lucrative India market.

“At a time when Zomato and Swiggy have scaled down operations, and the consumer demand is muted, it remains to be seen how Amazon rides it out, and gains consumer acceptance in the midst of the crisis,” said Ram.

According to an Amazon spokesperson, the company is adhering to the highest standards of safety to ensure its “customers remain safe while having a delightful experience”.

Both Zomato and Swiggy are going through tough times as orders have dried up in the lockdown and social distancing times.

Swiggy this week announced to lay off 1,100 employees, nearly 14 per cent of its workforce, spanning across grades and functions in the cities and head office over the next few days as COVID-19 continues to hurt its business across verticals.

Last week, Swiggy’s closest rival Zomato announced to lay off nearly 13 per cent of its workforce — over 600 employees — via Zoom calls, along with salary cuts for the rest of the employees for at least the next six months starting June, with higher cuts going up to 50 per cent for people in senior roles.