New Delhi: Founded by Indian Institute of Technology (IIT) Roorkee Graduates, Kush Taneja and Sambhav Jain, FamPay is “India’s first mobile-based banking services for teenagers that brings cashless convenience and much more to millions of teens and their parents.” It allows minors to finally make online (UPI & P2P) and offline payments without the need to set up a bank account.

IANSlife spoke to them to know the details of the innovation and the idea behind it. Read excerpts:

What is the problem you are trying to solve and who is your target audience?

Jain: Today’s teens are digitally savvy, having grown up with technology as a mainstay in their day-to-day lives but so far have not had a digital payments solution to go cashless. A recent RBI report quoted a 23 percent rise in transactions per person and 87 digital payments apps in play. None of these apps however, include the pre-banked segment of teenagers in the digital payments ecosystem. There are an estimated 250 million+ teenagers in India in the 12-18 years age group of which 20 million have smartphones. They are still reliant on getting cash for their expenses from their parents. This has now become an even bigger challenge in times of COVID-19 where most of the buying has moved to digital.

Another problem that is faced with cash is that parents do not have any visibility into the expenses made by their child. With FamPay and its numberless card, minors can finally make online (UPI & P2P) and offline payments without the need to set up a bank account. Parents can send money to their kids on the app, with control and supervision over the amount of money the teens have and spend. In addition to the card, teens get their own unique UPI ID with which they get first-hand access to the growing UPI Payments network.

What are the unique features of the app?

Taneja: FamPay and its numberless card, allows minors to finally make online (UPI & P2P) and offline payments without the need to set up a bank account.

It offers the perfect combination of parental control and independence for teens. Users can maintain a zero balance and there are no hidden charges or costs attached to any transactions.

Designed for the new age generation of teenagers, the app offers many cool social features. The app sports a social feed where friends can share their recent spends and react to updates. The app uses gamification to make money management fun. Teens are rewarded with a cashback on achieving a certain amount of savings for example each and every winner gets a chance to double their savings as well.

What is the idea behind the Famcard? What change/innovation are you looking at bringing in?

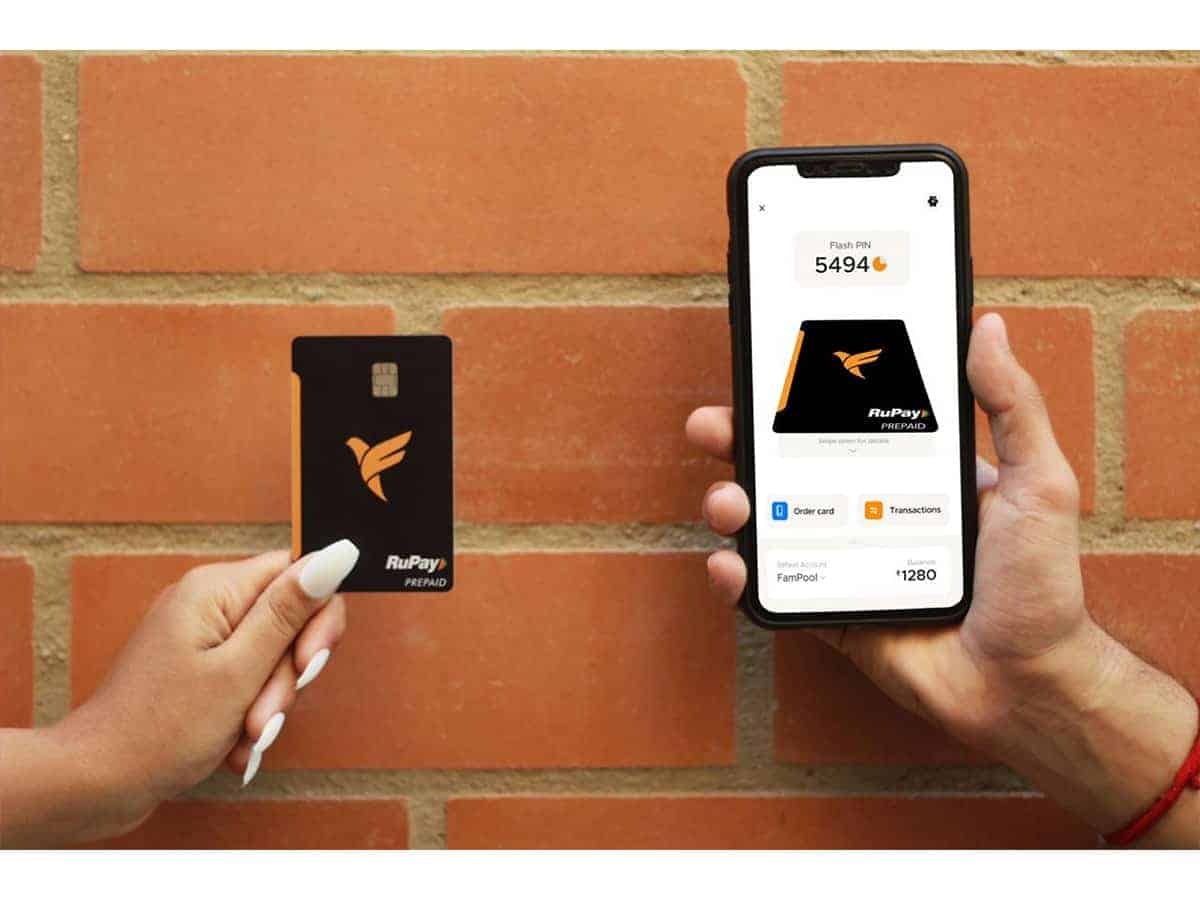

Jain: FamCard is a first-of-its-kind numberless card that teenagers can now use to make payments online and offline independently, relieving parents of the trouble of giving them cash or their credit/debit card.

It has no numbers on the physical card which makes it very secure. It also has a special feature of “Flash PIN”, which is dynamic and is generated for every transaction. Teens can just flash this PIN to the cashier for offline payments, without the need of entering the PIN by themselves on the POS machines, allowing for true contactless payments amidst COVID-19.

Any product that addresses the needs of GenZ teens will have to resonate with their vibe. The design of the card is minimalist, sleek and it is a vertical card that matches their aesthetic style. The unconventional vertical card design is a hit with the GenZ and they do not need to worry about numbers on the card fading with the passage of time.

FamPay worked with NPCI to make this ‘first in India’ numberless card a reality. They collaborated to solve the complex backend supply chain which had to be reimagined and reconfigured to realise this pioneering effort. This card has been launched in partnership with IDFC Bank and is accepted across the RuPay payment network of merchants.

Is it like any other debit card?

Taneja: It is like a debit card, but is unique because you do not require a bank account to get the card. Also, unlike other cards this is only available to teenagers. Cards carrying the 16 digit number have been used for years now, but this number is not really required on the card when transacting offline. Our card is an innovative product in the sense of utility, one in a few across the world and the first in India. It facilitates contactless transactions with utmost ease and security.

How will you be ensuring security so as to minimize frauds?

Jain: We have the required licenses from RBI to operate the business and have partnered with IDFC bank and RuPay. The KYC check prohibits fraudsters from using the app without verification.

The card is specially designed for teenagers and we understand the importance of it being as secure as possible. As FamCard has no numbers, all the card details are saved on the FamPay app and there is no need to refer to the physical card to fill in details during online transactions. There’s no fear of card information getting disclosed in case it gets stolen or lost and the card can be paused, blocked and managed at fingertips on the app. Every transaction is protected with device locks like fingerprint, Face ID, pattern lock or PIN.

What are your future plans?

Taneja: We are starting with digital payments but aim to grow as our users grow. FamPay would like to become the de-facto platform for teens and families that offers teens their first step to making payments digitally, managing their finances and understanding money management skills. With a mission to raise a new, financially aware generation of Indians, FamPay is fuelling the cashless future and opening up its convenience to an entirely new and untouched segment of users.